How Do You Add Your Paycheck To The Mint App

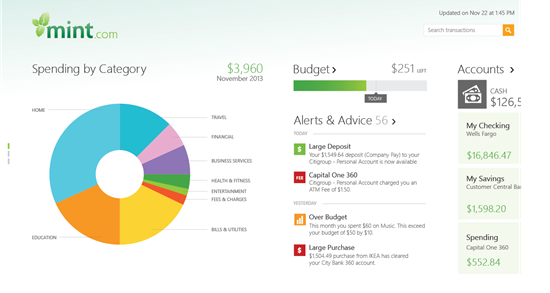

In Post 14, we explored the reasons why tracking your expenses is so of import. This post will now guide you through setting up your Mint business relationship to propel you forward on your journey to fiscal independence . This tin actually be pretty fun. Permit'south get started!

Set upwards an account

First, you demand to prepare up an account . Yous should practise that on the Mint.com website and not your phone. You will likewise demand any usernames and passwords for whatsoever financial accounts you currently have. I matter I like nearly Mint is that they are non interested in knowing your proper noun, address, or social security number. After you accept set up upwardly your account, you should download the app to your smartphone, as that is how you will be using Mint the well-nigh.

Sync all your accounts

When you are setting up your business relationship, Mint will prompt you to enter all of your financial account information. In one case they have information technology, Mint volition automatically pull all the transactions and put them in your Mint account. At this point in your life, you may only have one or two accounts similar a checking account and a credit card. But as you get older, y'all will add many more accounts to your financial portfolio, and you can add them to Mint equally you go them.

The best thing nearly Mint and similar apps is that it does all the work for you. Past pulling all your fiscal transactions into one place, you don't have to practise whatever math or transfer any data. It's simply automatically there for y'all to review. Easy peasy, lemon squeezy!

Go along in listen : It takes a few days for transactions to appear in Mint, so the balance that Mint shows for your accounts is usually not current. Therefore, using Mint to await up your checking business relationship rest is not a good thought. To encounter your checking account balance, use your bank's app.

Cash transactions

The ane matter Mint cannot keep track of is anything yous purchase in cash. Thankfully, cash purchases are pretty rare nowadays. Usually, we use our debit cards, credit cards, Apple Pay, Google Wallet, or another electronic payment method when making our purchases. These electronic payment methods work well with Mint, but cash transactions are not trackable past the app.

The answer: add transactions into your Mint account for each cash purchase you brand then that your expense totals are as accurate equally tin can be. You Need to practise this so your expense totals are genuinely representative of where your coin is going.

"So, what if I make a purchase with greenbacks?"

Here's what I do. I have a note in my phone that is titled "Spending". Whenever I spend cash, I open that note and apace type what that purchase was, the date, and the amount. Then, once a calendar month, I go to Mint and enter each of those cash transactions into my Mint business relationship. I take a monthly reminder in my phone calendar to enter the cash transactions from my phone note. Hint – before yous review the previous calendar month's numbers, brand sure you've entered all the cash transactions for that calendar month.

Y'all will as well need to practice input any cash y'all receive into your Mint account too. For example, if you lot receive $50 greenbacks from your parents for your altogether, you should go to Mint and input that $fifty cash as income. If you become paid in greenbacks (maybe you mow a neighbor's backyard for $20 cash), you will likewise need to add that transaction into your Mint account as cash income. Just use the same telephone note mentioned in a higher place to go on rails of cash income until y'all enter the income into the app.

Even meliorate, you lot can categorize each cash income transaction as something similar "lawn intendance income". Remember that the more than detailed you are, the more informative and useful the reports, charts, and analyses volition be for you.

ALL of the greenbacks that yous receive must be recorded as income then that your monthly statements are accurate.

Features

At that place are lots of handy tools that brand it easy to keep rails of everything. For instance, if you make a purchase from Amazon that includes some wear and some school supplies, yous can split that one transaction into separate parts and assign each of them to their appropriate expense category.

Yous can also input the approximate value of your personal property, such every bit your machine, music equipment, or a bike. If you ain a car, Mint will grab the value of it off of the internet from trustworthy sources such as Kelley Blueish Book . (If you have a motorcar loan, don't forget to enter that data under "Loans".) Y'all can besides input the estimated value of other personal belongings. Be careful not to overestimate the value of this stuff. A good rule of thumb is that the maximum amount information technology would be worth is one-half of what you lot (or someone else) paid for it when it was brand new. Sad, merely true. Mostly, the older the item is, the less it is worth of that maximum "half-toll" amount.

Afterwards you lot have entered everything, yous will be able to run across your net worth. It's a lilliputian easier to find on the website version of Mint than the app version. In that location's as well a way to see your net worth history over months and years on the website, which is pretty absurd to continue rails of. If your cyberspace worth is currently a negative number, don't judge yourself or get upset. You are immature and take enough of time to get it right.

Beingness able to see where your coin goes

Once you have tracked your spending for a month or two, you tin can go in and wait at what Mint calls your "Trends". Past clicking on this tab and choosing a time frame (such as "final month") and a category (such as "amusement"), you tin can instantly run across how much y'all spent. Knowing how much you lot spent on entertainment terminal month (or some other category) will change you non considering you've set a budget for that category and you want to stay under that amount, simply because you volition see the full for each category and know y'all tin do amend next month.

That's why I stress that you need to track your spending rather than take a upkeep. If you set a budget amount for amusement at $200 per month, you might exist tempted to spend until you hit that $200 marker. But if you don't have a budget amount and you lot see that y'all spent $200 last month, you will probable say to yourself, "How did I spend that much? I can crush (spend less than) that this month!"

Categories

Mint has main categories and subcategories already fix in the app. However, you volition probable need to add subcategories as you track your expenses over the outset few months. The subcategories you add volition reflect the uniqueness of your life. Y'all will continually be adding or revising subcategories equally y'all get through your first few months.

Remember, you are likewise tracking all of the money that flows INTO your life likewise. Mint has a main category called "Income", and it has preassigned subcategories. Y'all should add a subcategory for each way that money comes to y'all. These could include: Allowance, Lawn mowing, Babysitting, Gifts, Cinema paycheck, etc.

You need to observe your spending amounts for each category over each month and slowly conform your patterns of spending. Every bit a young person, yous are probable non spending thousands of dollars every calendar month every bit an adult may exercise. But you are likely still spending some money on games, shows, gas, eating out, clothing, electronics, etc. As y'all track your spending for these categories, y'all may (or may not) be surprised at how much money yous are spending on each. If it's a number that is a lot higher than yous might have guessed (or think that number should be), and then permit the adjusting to a frugal freak level brainstorm. Every dollar you spend should bring you great value in return. If it didn't, then it would have been better to relieve that dollar.

Conclusion

And then create your account (Mint or other preferred option), connect your financial accounts, and start exploring the options similar a freak . Make this your go-to place to see your overall coin moving-picture show. I bank check my Mint app at least once a day to run across what's going on. It tin likewise tell yous about upcoming bills you need to pay or big expense transactions that you should double-check.

At present go out there and become your freak on!

How Do You Add Your Paycheck To The Mint App,

Source: https://www.sheeksfreaks.com/post-15-the-ultimate-guide-to-setting-up-your-mint-account/

Posted by: hazeltonopurnisting.blogspot.com

0 Response to "How Do You Add Your Paycheck To The Mint App"

Post a Comment